Hardcover |

Kindle Edition |

Thrilling Incidents In American History |

Perry's Saints |

Prev |

Next

Hardcover |

Kindle Edition |

Thrilling Incidents In American History |

Perry's Saints |

Prev |

Next

The Jet MakersThe Aerospace Industry from 1945 to 1972• Title • Introduction • Preface • Acknowledgements • I: World War II: Aviation Comes of Age • II: The Aerospace Industry since World War II: A Brief History • III: The National Military Strategy: Background for the Government Markets • IV: The Principal Government Market: The United States Air Force • V: The Other Government Markets: The Aerospace Navy, the Air Army, and NASA • VI: Fashions in Government Procurement • VII: The Heartbreak Market: Airliners • VIII: Design or Die: The Supreme Technological Industry • IX: Production: The Payoff • X: Diversification: The Hedge for Survival • XI: Costs: Into the Stratosphere • XII: Finance and Management • XIII: Entry into the Aerospace Industry • XIV: Exit from the Aerospace Industry • XV: The Influence of the Jet Engine on the Industry • Notes • Acronyms • Annotated Bibliography |

VIFASHIONS IN GOVERNMENT PROCUREMENTNearly as important as why and what the government bought, is how it was done, or the mechanics of buying. The first two are concerned with product differentiation, and the last with the vital matter of price. Despite the presence of airline and foreign customers, there is no practical existence of a market to set the price for aerospace products. They are expensive, even for the United States government. They must be sold before they are made or, often, even designed, because the industry works on the frontiers of technology. The government reserves the right to break its contracts-including price agreements-so it is hardly a normal buyer, aside from its special relationships with the industry as financier and regulator. Pricing is therefore critical and difficult. A price which is too low could bankrupt the manufacturer if that were politically realistic; one which is too high is politically unacceptable. The desired product is often beyond the technological state of the art, and the costs of design and development thus depend upon technical unknowns. This includes "unk-unks," unknown-unknowns, or the unexpected. In addition, complex fabrication and assembly lead to difficulty in forecasting initial production costs, although once the first few models have been made, usually fifteen to thirty-five, production costs are usually predictable.1 Forecasts are based upon learning, or logistic, curves developed from years of previous results, and the aerospace industry expects that costs will drop to 80-85 percent of the first lots' cost after the production quantity has doubled.2The history of government procurement policies for aerospace goods since World War II is a series of attempts to grapple with this problem of price where neither market nor specific product is in existence. As purchaser of most of the industry output, the government has tried to avoid using its powerful position to drive the price down as far as possible. The reasons have been both altruistic and practical. If the companies were driven to bankruptcy, a source of indispensable and irreplaceable material would be gone-irreplaceable because there is doubt that government arsenals could deliver as much of the product in comparable quality and as quickly as private firms; the government must seek to get "the most for its money the soonest," since aerospace articles not only wear out but often become useless because of rapid technological advance. Too, as the recent Lockheed crisis has shown, the government shrinks from the economic dislocations of a large bankruptcy. So the government has sought, through its procurement system, to provide a reasonable profit to the firms while providing a contract that will both help and motivate the industry to cut its costs. In the quarter of a century after World War II there were recurrent company crises and some failures, and there were serious complaints about high profits, waste, and procurement practices themselves.3 THE PERIOD OF CALM: 1946-1950In the postwar years, profits and prices were not a great issue in government procurement. As a whole the industry was profitless, and prices for aircraft, although regarded as high, were not considered excessive. There was no strong dissatisfaction with the contract system that continued to operate after World War II. The cost plus fixed fee (CPFF) had worked well compared to World War I's cost plus percentage of cost (CPPC). After the war, intentions were to start with a CPFF contract early in a program, when the costs were so uncertain that they could not be estimated closer than plus or minus 30 percent, and then use negotiated fixed price contracts for subsequent production lots, when the learning curve was a fairly reliable basis for setting costs. The fixed price contract need not be as fixed as its name implies; it could be very flexible, in practice, because it could call for periodic "redetermination" points at which the price could be adjusted as experience indicated. Such contracts can, in fact, be regarded as a variation in the cost reimbursement method. Despite the obvious potential problem that the higher the estimated costs the higher the percentage profit, or fee, the Air Force learned with time that the CPFF contracts often proved to be the cheapest kind, and that a specific situation determined the most favorable contract form. The World War II procurement practices were thus generally carried forward into the postwar period, and although the Armed Services Procurement Act of 1947 specified that advertised bids were to be used, most aerospace contracts were negotiated under exceptions allowed by the act.The Navy preferred a type of contract it had initiated in 1942, the "incentive" type, although it also used the other kinds of contracts. If the incentive program went as expected, the fee would be the same as for CPFF; if costs varied from the original estimate, the government and the firm would share in the savings or cost overrun, except that beyond a certain preset level all increased costs were borne by the company. This form of contract, by its very nature, demanded more elaborate cost accounting, but the Navy hoped the incentive form would motivate cost cutting by the contractor. The Air Force included it as a contract type in 1955. The service organizations doing aerospace procurement were the Air Force's Air Materiel Command (AMC) and the Navy's Bureau of Aeronautics (BuAer) and Ordnance Bureau (BuOrd). AMC was in decline as a procurement agency from the end of World War II until its dissolution in 1961. An important step in its slide was the formation in 1947, by General Curtis E. LeMay, of the Aircraft and Weapons Board, which was set up to make the final decisions on procurement. In 1948 this board's duties were taken over by the Senior Officers Board, whose name was later changed to the Air Council. These boards were composed of selected top generals; and since adherence to and experience with the big bomber doctrine has been important to promotion to that level, Air Force decisions on all aerospace procurement have reflected the outlook of that group. It is difficult to exaggerate the importance of this parochialism in Air Force procurement and the combat capability of the service itself, aside from the delays caused by high-level review. THE MISHANDLED MOBILIZATION: 1950-1953Planning for mobilization was important in the postwar years. On the eve of the Korean War there were seventy-five aircraft plants in reserve and a large government stockpile of machine tools and materials. Contracts for wartime production had already been prepared. Yet the plans were found to be nearly as useless as those for the Second World War, for they were based on mobilization for total war, reflecting the one-war national military strategy of the time.At first it was decided simply to double aircraft production, a procedure which was within the existing capacity of the industry. Related to the war was concern for NATO strength, and production was accelerated for 1,600 fighters for Britain, France, and Italy. Guided missile development also received attention; a central agency, the Office of Guided Missiles, was established in 1950 to expedite the services' thirty-five missile projects. Production of missile material was to double by fiscal year 1952 and undergo a further 50 percent increase by 1954. K. T. Keller, president of Chrysler, was named as director of the missile agency, reporting only to the secretary of defense and the Armed Forces Policy Council. Financing was needed immediately for the programs; the Federal Reserve consequently reactivated the V-loan program, which had provided $2 billion to the aircraft industry in World War II, and the General Services Administration provided government-owned machinery for lease. The entry of China into the war in October 1950 again altered the course of events sharply. Afraid that the intervention was part of an escalation to World War III, Truman declared a war emergency and emulated Roosevelt by making an unrealistic call for 15,000 planes together with a $11 billion supplemental defense appropriation. This meant a fivefold increase in production in one year. World War II's best growth was only threefold and with simpler aircraft. Congress was willing to provide funds almost for the asking, yet the Joint Chiefs of Staff were unable to present a program immediately even though plans had been worked out in the spring for full mobilization. Evidently, as happens frequently, the plans were unacceptable to superiors when the applicable situation arose. The Air Force program costing $4.5 billion was settled in an all-night session of its Senior Officers' Board on 5 January 1951, a circumstance hardly conducive to effective decision making. General Electric's president, Charles E. Wilson, became head of the new Office of Defense Mobilization, which had been formed in December 1950 and immediately faced shortages in men, materials, and machine tools. Not all the stockpiled tools, many of which were left from World War II, were suitable for changed production methods. In this frenzied atmosphere the auto industry again entered into aircraft production. Not surprisingly, the aerospace companies willingly embraced subcontracting to avoid overexpansion in those uncertain times. Before this period, subcontracting had been done reluctantly and at government urging. During World War II Lockheed had subcontracted only 18 percent; in 1951 it was 40 percent.4 Lockheed's attitude toward subcontracting at this time is illustrated by the fact that in 1952 its Constellation airliner, whose sales did not depend on the zigzags of government buying, used practically no subcontracting. By contrast, subcontracting on its military aircraft ranged from 31 percent on the F-94 to 51 percent on the P2V.5 This time the rise of subcontracting marked a permanent change in attitude in the aerospace industry, and subcontracting became an accepted, routine practice. It was a wise move for the firms. As the months passed without renewed crises, there was a gradual relaxation of efforts to achieve emergency goals. But it was relaxation, not reversal, and action to further production continued: the Aircraft Production Resources Agency was established in 1951 to solve a war materials problem which had arisen; an attempt was made by the Air Force to freeze designs; and the World War II Boeing-Douglas-Lockheed cooperative arrangement for building B-17's was revived in 1951 to mass-produce B-47's. The material and tools shortages continued to limit production, with tool problems alone estimated to reduce output by 20 percent in the early part of 1951. As in World War II, combat forced reequipping with more modern aircraft designs. There were strikes against materials suppliers, and the increased labor turnover and the absenteeism that go with a manpower shortage. Probably most important, the attempt to increase production occurred at the same time that the transition to jet aircraft manufacturing techniques was at its height. At the end of 1951 the production rate was 450 aircraft per month, which was not even twice the December 1950 rate of 250. The total production was roughly 5,000 aircraft, far short of Truman's goal of 15,000, although it is not clear whether he wanted his aim to be achieved in 1951. There was a mild shake-up of top mobilization managers at the end of 1951, and new goals were set that acknowledged the existing bottlenecks-which were primarily in engine production-and tried to reduce the sting of rising costs. By the summer of 1952 jet engines were still the bottleneck, but attention was diverted when W. L. Campbell, acting chairman of the Defense Production Administration's Aircraft Production Board, dropped a bombshell. Either he alone saw the truth, or no one else was willing to act. He told the Defense Department that it was needlessly producing obsolescent aircraft as well as too many different types for each purpose. Campbell's list of obsolescent or redundant aircraft which he said should be terminated or cut back included twelve types, some produced for the Air Force and some for the Navy. There was an instant rebuttal which defended production of the older types, but some of Campbell's recommendations were soon quietly put into effect. More cutbacks followed but only because of the insistence of Defense Secretary Robert Lovett. The next year, in the late spring of 1953, a scandal broke when Congress learned of the slow production and high cost of C-119's built by Kaiser- Frazer at Willow Run. Kaiser's aircraft cost almost three times those of Fairchild. The Air Force canceled Kaiser's contract a few days after the matter exploded in Congress. It was revealed in congressional investigations that General Motors' contract negotiators had got the better of an Air Force team and won windfall profits from building Republic F-84F's, and that the Navy persisted in ordering McDonnell F3H fabrication with a deficient engine against the manufacturer's advice, until the fighter had taken several lives. Perhaps an estimate of the efficiency of the period can be made from the fact that it sometimes took the services two years to convert a letter of intent to a contract; it should be done in less than ninety days. Almost at the same time as the Campbell affair the qualitative procurement of missiles came under attack. Although the missiles' "czar," K. T. Keller, had gotten them into quantity production with a "bruteforce" approach, he either lacked authority or had been unable to use it to force coordination among the services in missile development. Missiles were in production which could be shot down by obsolete piston fighters. Antiaircraft missiles were being developed without any reference to the air defense radar and control system, and were even being designed for altitudes lower than aircraft operational levels. In September 1952 the secretary of defense was given legal authority to run all armed services procurement, while the war emergency machinery was being slowly phased out. This was an important step towards separating the services from their procurement powers. It appears that the services have only themselves to blame, for the Campbell, Keller, and other incidents demonstrated inefficiencies in service procurement both in weapon quality and cost consciousness. The production record of the Korean War, shown in Table VI-1, demonstrates one important thing: production rose in spite of some governmental mismanagement and the fact that this was the principal period of conversion from piston to jet propulsion, which requires somewhat different production methods. Otherwise the record is blurred because the period of frantic effort did not begin until six months after the war began in June 1950, and the steam went out of the effort six months after the panic of December 1950. TABLE VI-1 AIRCRAFT PRODUCTION FOR THE KOREAN WAR

INNOVATION: 1953-1960The end of the Korean War brought not only the realization that the jet age had arrived, but also some shock at the costs associated with it. Consequently, military procurement in the Eisenhower era was dominated by the clash between desire for the new technology and its derivatives, missiles and space, and their costs. There were not only the natural responses of stretching out programs, of trying to transfer the expense to industry, and of attempting closer controls; there was also imaginative innovation in procurement and management, mostly by the Air Force.Defense Secretary Charles E. Wilson, not the same man as the director of Defense Mobilization, set the tone for the administration in 1953. He announced that government commitments would be for shorter terms, and that failures to meet schedules would mean cancellation even if the contractor was not at fault. The industry was told its inventories were excessive and would be reduced by 30 percent, for the Defense Department was not going to finance all of them. In addition, there would be cuts in progress payments, program cuts, and stretchouts. In 1954 and 1955 similar steps were taken to cut procurement costs. Spares were to be reduced by 25 percent in a renewed emphasis on inventory costs, and there was to be more testing before a decision to manufacture. Penalties for failure to perform were threatened. Fixed price and incentive contracts were to be emphasized, and in 1955 those contract types were in fact dominant. But as the fifties went on, with lowered production runs and more development, the CPFF contract rose in use again until it alone formed, in 1961, 38 percent of all awards. At the same time, incentive contracts became more popular despite the concern of influential Congressman Carl Vinson, who saw that one of the major problems with the incentive contract form was that it motivated a contractor to inflate initial cost estimates. It has had other basic problems: in many cases the contractor would be better off if he raised his direct costs; this would increase the overhead paid, assigned as a percentage of direct costs, and he would benefit more from this gain than he would lose from the reduced profit fee which declined on a sliding scale as his expenses rose. Finally, because estimating costs on unknowns is difficult, the incentive contractor knows he may be penalized after excellent performance or may gain a windfall on a job poorly done. As late as 1969 no one could produce evidence that incentive contracts accomplished their purpose. In the summer of 1957 there was another major effort by the Defense Department to cut costs. Besides program cancellations and stretchouts, limits were placed on overtime and progress payments were reduced. There was also a drive to reduce the proportion of government-owned facilities. Government stockpiling of tools was abandoned, as were mobilization plans, for the Air Force's belief in a short nuclear war-and, hence, no need for mobilization-fit in neatly with the desire to cut government expenditures. In 1960 the Navy launched its own renewed effort along lines which were now familiar: penalties for contractor failure to meet a schedule, an aversion to cost reimbursement contracts which was so strong that attempts were even made to end them on research and development projects, and a reduction in government-owned plant and equipment. The repetitive nature of these drives to reduce costs with the same formulas indicates that the measures were palliatives. Several more imaginative efforts were made. The most conspicuous were organizational changes. For the crash development of ballistic missiles, each service established a specialized agency with top priority. The Air Force led with its Ballistic Missile Division in 1954, followed by the Army Ballistic Missile Agency and the Navy's Special Projects Office in 1956. These Manhattan-Project-like agencies operated effectively but continued to undergo modification. In 1951 the Air Research and Development Command (ARDC) had been established both to recognize the growing role of R&D and to procure it more effectively. Previously, R&D had been bought by the Air Materiel Command within the Air Force, but in the fifties the Air Materiel Command had a tendency to concentrate on traditional buying patterns; and the Air Force became disappointed with the Defense Department's Research and Development Board, unofficially called the "Retardation and Delay Board," which lost itself in a maze of 16 committees, 174 panels, 284 subpanels, and 3,000 special consultants. The Air Research and Development Committee, chaired by H. Guyford Stever of the Massachusetts Institute of Technology (MIT), reported that the problem lay in the Air Force's tendency to keep decision-making at excessively high levels, a not-surprising conclusion in light of the Air Council discussed above.6 The Air Force, however, believed its problem lay in having split its procurement function between the Air Materiel Command and the Air Research and Development Command. Its solution was to move all procurement in 1961 to a successor organization, the Air Force Systems Command (AFSC), named for the weapons systems concept. The Navy had already merged its Bureau of Aeronautics and Bureau of Ordnance into a Bureau of Weapons in 1959, a reflection of the convergence of aerodynamics and weaponry. The new organizational form was soon adopted by the Army, which abolished its traditional technical services and set up a Materiel Development and Logistics Command (MDLC) in 1962. The weapons system concept was first presented to the Air Force by the AAF Scientific Advisory Group, which recommended that this German method be adopted. Air Force custom had formerly been to buy its engines, armament, radios, and so forth directly and then present them to an aircraft manufacturer for inclusion in an airplane design. These items were called government furnished equipment (GFE) or GFP ("P" for parts) or GFAE ("A" for aircraft). This method of buying has obvious advantages in equipment standardization and quantity-purchase savings, and in addition it had a special attraction to government as another means to use procurement to achieve socioeconomic goals, because the government dealt with more companies this way. However, as aircraft became more complex, and also denser with additional equipment, it became increasingly difficult for the aerospace firms to accommodate their designs to "off-the-shelf" parts without a loss in performance. Even when this was done, the newer electronics parts demanded avionics skill in aerospace designers. Avionics proved to be the precipitating factor for change. Under the weapons system concept one agency became responsible for assuring that all functions, except engines, became an integrated whole with optimum performance. Since the aerospace companies were already using this approach in their airliner products, the new concept was not a sharp break for them. Also, the Air Force intended to use the new method only where it was better. The first contract using the weapons system procurement concept went in 1950 to an airliner manufacturer, Convair, for the F-102; but this first step was a halfway move, because Hughes Aircraft provided the armament. The first complete use of the system again went to Convair, this time in 1952 for the B-58. Soon the Navy adopted the method, and then the Army, dealing a blow to its arsenal system. By 1958 90 percent of Army R&D was being done by industry. Adoption of the weapons system concept had the effect of further centralizing procurement decisions in the services and of greatly enlarging the aerospace firms' managerial and technical staffs, their overhead. It also enlarged the scope of make or buy decisions by the aerospace companies, especially for avionics. The F-102 was not only the pioneer aircraft for the weapons system concept, it was also the first to fully test another Air Force effort to cut costs. This attempt was precipitated by three aircraft development events which had occurred: a medium bomber was put in production before it could be made combat ready, and the modifications on the finished aircraft equaled the original production cost; a fighter was ordered into production after two hours of Bight tests, but later structural failure required extensive rebuilding and made junk of a large supply of spare parts; and another fighter demonstrated major problems in Bight test after 300 production models had been built. The new idea was to start production at a slow rate while testing up to fifty models. In the past, three aircraft had been considered to be enough for test, but months of testing had been required; the increased number was intended to reduce the length of the testing period while still accumulating sufficient flying hours. The aircraft would be production models and not prototypes. This plan was called the "development-production" or "concurrency" system, and it was copied by the Navy. The F-102 proved to be a disaster for this concept, however. Forty-two aircraft for test were ordered and slow production began, but on the first Bights in 1953 and 1954 the F-102 performed far below expectations with its traditionally streamlined fuselage. Richard Whitcomb's area rule formula with its "Coke-bottle"-shaped fuselage was then tried as a solution and it worked. This change required a second production tooling and the scrapping of ten aircraft. Subsequently, the second design was given up as too heavy, after another four had been built. There was a third tooling-up before an acceptable, highly successful aircraft was produced. Thirty million dollars in tooling had become scrap, and more money was lost on reworked or scrapped planes. The concurrency plan appears to have been successful in the Air Force's development of the ICBM, where it was regarded as a necessary gamble to hasten operational readiness in the missile race, but it was ill-conceived for both production and testing of manned military aircraft. The preceding, long-successful system of testing three fighters for a total of 1,000 hours meant about 350 hours for each model. The concurrency method was to test fifty aircraft. This would amount to only 20 hours of test per aircraft, assuming no increase in total hours and equal time per aircraft, assumptions which are probably unwarranted, especially because the aircraft would be built in sequence. Nevertheless, it still appears the plan cut testing hours too short. Kelly Johnson thought twenty test aircraft was excessive for military aircraft, and believed less than twelve would do for most programs.7 For the Lockheed L-1011 jetliner, flight tested in 1970 to 1971, it was planned to use six aircraft for 1,695 hours; the least time on a test aircraft would be 240 hours, and the most 395, times which accord well with the original, preconcurrence system.8

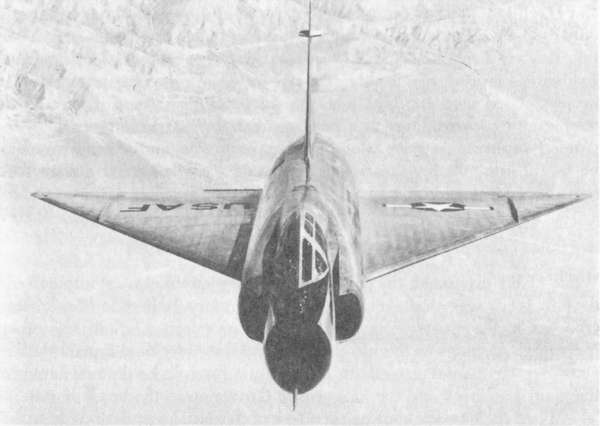

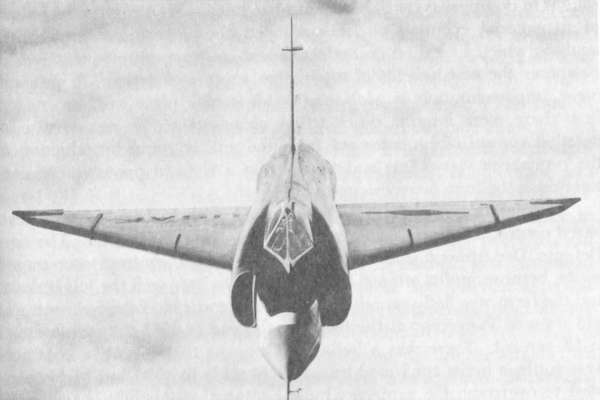

These photos clearly show the extensive fuselage changes made in the development of the General Dynamics F-102. The later aircraft using Richard T. Whitcomb's area rule is at bottom. Courtesy General Dynamics Corporation. In the late fifties the Navy, together with Lockheed and Booz, Allen, and Hamilton, worked out a development tool subsequently adopted not only by the Air Force but by much of industry. This was Program Evaluation Review Technique (PERT), in the Air Force called PEP (Program Evaluation Procedure), a computer aid for monitoring the progress of a project. Used with the highly successful Polaris program, it seemed to offer exciting possibilities as a management tool. It has since, with expanded applications, been used on many programs, and it has proved to be useful but not the panacea or substitute for managerial ability that some hoped it would be. THE McNAMARA REGIME, 1961-1968While PERT expanded, the cost reimbursement contract went into a sharp decline, for it was anathema to Defense Secretary Robert S. McNamara, who has had a greater impact on defense procurement than any other individual. Perhaps he has also had the greatest individual impact on the aerospace companies as well, for the contract formula he devised brought the giant Lockheed and the long-sturdy Grumman to the brink of ruin.When McNamara became secretary of defense he undertook to make the Defense Department more efficient. The primary means by which he sought to do this was by tightly centralized decisions using the technique of managerial economics. He employed the economists' cost-benefit analysis which he called cost-effectiveness, and opportunity cost, which compares the cost-benefits of alternative courses of action. In procurement, implementation of McNamara's ideas took place in three stages: first, there were interim, quick-action changes; second was seizure of detailed control of procurement from the military, and introduction of the economics viewpoint; and third came a shift to procurement contracting in the form he envisioned as the best. McNamara's immediate actions started with a drive to stop cost-based contracts and use fixed-price and incentive ones instead. The new Defense Department leadership believed the cost contract encouraged waste, because profits are not directly linked to how well the job is done, and the form was flatly repudiated. By 1961 cost plus fixed fee contracts had risen to 38 percent of the total; by the end of 1963 they were down to 12 percent. There was a belief in Congress that incentive contracts were futile, a belief confirmed by a RAND study in 1966, but McNamara tried to overcome the problems by enlarging the possibilities for profit and loss in the contracts. Industry was still not convinced on incentive contracts, however, believing it was at the mercy of its subcontractors and of government negotiators who would still take the bureaucratic, cautious approach and set the contract profits as low as possible. McNamara also adopted an Air Force idea of the late fifties which tried to secure the most efficient combination of negotiated contracts and bidding; it was called "two-step procurement." In the first step, winners were selected in a design competition which disregarded price; the second step consisted of submission by the winners of sealed price bids. The 1957 decision to delay progress payments was reversed because this led to government allowance of interest as an expense, and McNamara believed this was more expensive than prompt payment; but he continued the efforts to remove the government from ownership of plant and equipment. McNamara also tried the reverse of an Air Force experiment of the fifties. The Air Force was not favorably impressed with the paper proposals it had been getting, and it thought it might save money and time by eliminating the preliminary design stage in development. Contractors would be selected on the basis of past performance and present available capacity. But this either eliminated competition or shifted it to the prototype stage; either course was, subject to criticism, and the Air Force dropped the idea. Because the paper stage is cheapest, McNamara chose to emphasize it. He sought to arrive at as great a level of definition as possible in the earliest design work. This effort ran counter to another McNamara desire: that of ending the cost overruns associated with the practice of "buying-in" to programs. To buy in was to submit deliberately low initial estimates in hopes of winning an award, and then recouping losses later in the production phase, called "getting well." These tactics were also aptly called "iceberg procurement." The trouble with the paper stage is that it is the level at which there must be the greatest vagueness and uncertainty; therefore it lends itself to doubletalk and "brochuremanship": fancy briefings, brochures, pictures, and charts. The best bidder may not be apparent under such circumstances. In the F-111 design competition McNamara sent the designers "back to the drawing board" three times to get what he wanted; the proposals ran about 1,500 pages and cost Boeing, General Dynamics, and Grumman $25 million in the runoff period.9 The peak of brochuremanship was probably reached with the C-5A; the three competitors submitted 35 tons of paper proposals, enough to have loaded fourteen DC-3's.10 The F-111 contract competition was chosen by McNamara for his second step: to assert civilian dominance over procurement. Before the F-111, the USAF's multilayered selection and review arrangement, capped by the Air Council, had controlled procurement. Civilian leaders had been loath to reverse all that military opinion; their reluctance appeared wise when the unintimidated McNamara upset the generals' preference for the Boeing proposal and thereby set off a congressional investigation. The F-111 case has received intensive study, and McNamara's judgment holds up fairly well; the military's decision was tinged with emotionalism.11 McNamara's decision stuck after Congress had examined it, and he followed it up with a revision of procurement procedures which was designed to reduce the military's voice: he changed the service secretary's role from one of approval to one of decision. After the F-111 decision, McNamara moved to his third step: to establish the new contract form, the Total Package Procurement Concept (TPPC), which he hoped would end buying-in, improve service specifications, cut costs, and raise industry profits. This system required contractors to bid in their original proposals for the entire development and production of an aircraft or missile. TPPC was called "womb to tomb." The first total package contract was for the C-5A; it was negotiated by the government and Lockheed at a time when the administration sought to fight a guns and butter war in Vietnam. Despite shortages of manpower, tools, plants, subcontractors, and suppliers, no restraint was put on the civilian economy. The inflation rate rose, but it had been set in the C-5A contract at the past peacetime level, so the estimates were low. But the objectives of TPPC foundered on more basic reasons: provision was made for price redetermination for the second production run, and consequently the contract as signed was only a variant of a cost-plus arrangement; fixed prices for critical items such as ground-support equipment were not set, allowing the possibility of transferring overruns on the aircraft to the equipment; and the worst problem of all was the belief that the C-5A could use existing technology. TPPC was intended only for projects using state-of-art development, and since Lockheed had easily extrapolated the 67,000-pound C-130 into the 132,000-pound C-141, it believed the process could be repeated up to the 320,000-pound C-5A. But as the British investigators of the Comet disasters said, "Extrapolation is the fertile parent of error." Lockheed found itself struggling with unexpected technological problems which were a product of the huge size of the C-5A. Finally, there was inadequate monitoring of progress, so that by the time gigantic overruns were apparent top Defense Department and Air Force management had to conceal the costs or admit mistakes. They attempted to conceal them.

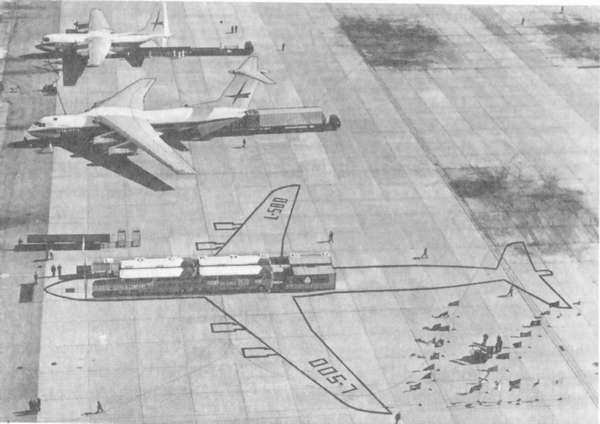

(From top to bottom) C-130 Hercules, C-141 StarLifter, and the outline of design L-500, which was to be the commercial version of the C-5A Galaxy and was to be the same size. The photo shows the step up in size from C-130 to C-5A. Courtesy Lockheed Aircraft Corporation.

A later TPPC contract was negotiated for the F-14 REACTION TO McNAMARA: 1968 ONFaced with criticisms of the McNamara procurements because of cost overruns, the Nixon administration reacted to them individually while choosing a different procurement course. The total package contract was abandoned. The emphasis on incentive contracts was dropped. Their use in development contracts was probably ineffective and resulted in unnecessary costs. There was a return to cost reimbursement contracts for development and redetermination clauses in which periodic price reviews are called for. In the Laird Pentagon these were called "milestones." There was also a return to prototype testing-the "fly before you buy" concept-recommended by the RAND Corporation in 1963 after an analysis of the procurement record. The RAND report had examined sixteen developments, and the results appeared to endorse conclusively the use of prototypes. RAND found that design competition instead of prototypes would have resulted in building the mediocre B-45 instead of the excellent B-47, for example; and that by-passing a prototype test phase saved neither time nor money because of the cost of unexpected problems which crop up.14 In 1970 the General Accounting Office (GAO) finished a study on Navy missile procurement and reached the same conclusion as the RAND study.15 Since the GAO report makes no mention of the RAND paper, it apparently was an entirely independent effort and lends weight to "fly before you buy."RETROACTIVE PRICINGWhile weighing the merits of prototype and test versus development-production is understandably useful, much of the emphasis on price formulas at contract time is incongruous because the government gave itself the power to reset prices after contract completion. There is a bureaucratic reason for fussing over contracts, however. If prices can be cut before or during a contract the service can use the funds elsewhere. When retroactive pricing is done, savings on lowered prices go to the treasury. The inconsistency was clearly seen by McNamara as an impediment to his hopes to cut costs through new procurement procedures.

The Renegotiation Board is the principal, but not the only, means the government has for retroactive pricing. From fiscal 1957 to 1964 the General Accounting Office claimed recovery of $109 million, mostly for erroneous cost data. By 1965 another pricing and profit problem existed for the aerospace companies. Profits on their government contracts were set as a percentage of the estimated cost. After World War II this percentage should have been, and was, lower than normal manufacturing rates as an adjustment for the large use of government instead of company owned plant and equipment. By 1965 the government share had declined, but the low profit percentages had not been corrected upward, largely because of the fear of bureaucrats who believed they would be criticized if they increased company profit payments above long-established levels.

The record of recoveries and of government price determination in

general shows the desirability of retroactive price setting, for

obviously some profits have been unearned. However, the government's

inadequate consideration of profits based on private investment, and of

the need for reinvestment in a capital-intensive business, for company

initiated research funds, as well as for cash for costly contractual

bidding which is not always reimbursed, has led to a situation in which

profits, in general, have been lower than deserved; the history of

failures in the industry supports such an assumption. Price

determination for the big commercial market has been on a more economic

basis.

|