Hardcover |

Kindle Edition |

Thrilling Incidents In American History |

Perry's Saints |

Prev |

Next

Hardcover |

Kindle Edition |

Thrilling Incidents In American History |

Perry's Saints |

Prev |

Next

The Jet MakersThe Aerospace Industry from 1945 to 1972• Title • Introduction • Preface • Acknowledgements • I: World War II: Aviation Comes of Age • II: The Aerospace Industry since World War II: A Brief History • III: The National Military Strategy: Background for the Government Markets • IV: The Principal Government Market: The United States Air Force • V: The Other Government Markets: The Aerospace Navy, the Air Army, and NASA • VI: Fashions in Government Procurement • VII: The Heartbreak Market: Airliners • VIII: Design or Die: The Supreme Technological Industry • IX: Production: The Payoff • X: Diversification: The Hedge for Survival • XI: Costs: Into the Stratosphere • XII: Finance and Management • XIII: Entry into the Aerospace Industry • XIV: Exit from the Aerospace Industry • XV: The Influence of the Jet Engine on the Industry • Notes • Acronyms • Annotated Bibliography |

IITHE AEROSPACE INDUSTRY SINCE WORLD WAR II: A BRIEF HISTORYDEMOBILIZATIONAL INSTABILITYAfter the war's end the American aerospace industry was quickly disabused of its hopes, finding itself in a classical situation of demobilizational instability. Government business was greatly reduced as the armed services returned to skeletal forces after the war. There was a catastrophic collapse of the AAF: from a high of 243 groups, or wings, in 1945 it shrank to such a degree that a few months after final victory there was not one completely ready squadron.One small break in the demobilizational pattern was in the AAF's interest in jets. Shaken by the experience of meeting German jet fighters and bombers in battle, the AAF put eight jet fighters and seven jet bombers into development. This was a fair level of research and development work, but the facilities of the aircraft companies at the time were nearly all in production plant and equipment. Production orders were needed to stay out of the red, and only a trickle of Lockheed F-80's and, a little later, Republic F-84's made up the AAF's first postwar jet programs. For the production-hungry aircraft industry there was also some hope of relief as a result of other AAF interests. The dream of a global bomber was still pursued, so prototype development of the Convair XB-36 and its flying-wing competitors, Northrop's XB-35 and YB-49, continued. The cutback in very heavy bombardment wings was smallest and, despite the thousands of B-29's built in the war, production continued on an improved B-29, which was redesignated B-50. The first plane designed for military cargo needs, the Fairchild C-82, was put into production. The Navy's immediate postwar effect on the aerospace industry was similar, but there was much less naval interest in jets. The Navy had not had the jolt of dealing with a jet-equipped enemy. Major technical problems in jet carrier operations loomed because of the low take-off acceleration and higher landing speeds of the new technology, and jets were not operational off American carriers until 1948. Secretary of the Navy James Forrestal believed jets were both unproven and overly expensive. The outcome was token production of the McDonnell FH and North American FJ jet fighters, and of the hybrid piston and jet Ryan FR. The Navy ordered production of three piston fighters and of some other aircraft developed late in the war: the Douglas A-1, which was needed because earlier Navy bombers lacked punch, and the Lockheed P2V for antisubmarine warfare (ASW). The industry had expected military business to be low, and hoped for orders for civil airliners. At first the airlines expected to buy many planes, but as traffic failed to continue to rise after an initial surge the purchase plans were cut back. Eight aerospace companies attempted to sell twenty-seven designs, ranging from those which never left the paper stage to serial production types, from feeder airliners to giants. Then there was the government, which was not only a poor customer for new aircraft, but was selling its surplus war transports at bargain-basement prices. Like the airline business, general aviation sales surged and then sickened. Money was lost on ventures like North American's Navion, which went $8 million into the red. The result during the demobilizational instability period was that nearly all airliner manufacturers lost money, although some probably contributed to their fixed costs including the vital retention of engineers. Sales in the demobilization period were actually double those of 1939, but losses were heavy, apparently because of larger overhead. In 1946 twelve aerospace companies lost an aggregate $35 million, and in 1947, $115 million. This was before taxes, and carry-back provisions reduced these losses to $11 and $42 million. The response of the companies at first took three forms. One company, Curtiss-Wright, husbanded its liquidity and took only minor risks because its president, Guy Vaughan, expected the usual postwar depression. Then there was a rash of merger discussions. Curtiss-Wright approached Lockheed, but negotiations broke down over the former's complicated capital structure. A proposed Convair-Lockheed merger was abandoned because of antitrust fears, an unsettled securities situation, and doubt by Convair over Lockheed's future when the Constellation airliners were grounded. A third response was diversification: aluminum canoes, kitchen appliances, buses, radio cabinets, toys, motor scooters, and other goods were made. With minor exceptions these attempts failed, although they may have contributed towards meeting fixed costs. By the latter part of 1947 the industry had run out of money, ideas, courage, and hope. It sank to forty-fourth in rank among American industries in 1948. The war-built reserves were consumed, and there would be no more tax carry-backs. Diversification in civil and non-aviation markets had failed. The industry turned to the government for relief. SIGNIFICANT EVENTS DURING THE TRUMAN ERAAppeals for help were made to the president's Air Policy Commission of 1947, the Finletter Commission, which was formed in response to the distress of the aircraft industry and dissension over the role of airpower in our national strategy. The commission listened favorably to the industry's plea and to the U.S. Air Force's (USAF) case for an airpower strategy. The Air Force presented to the commission a logical, comprehensive, specific system which seemed appropriate to the nascent Cold War, while the Navy's testimony was vague and chaotic. Eventually the commission accepted the Air Force's positions on strategy and strength, and also recommended planned procurement at a level calculated to sustain the aircraft industry and provide a base for mobilization. The findings of a congressional group called the Aviation Policy Board paralleled those of the Finletter Commission, and an air-nuclear-deterrent strategy was adopted.Although the build-up was now under way towards the USAF's goal of seventy combat wings designed for an era of American nuclear monopoly, the goal was not attained before the Korean War. Meanwhile, an armada of big bombers and aircraft of a wholly new class-the aerial tankers-was being maintained, and the program therefore represented an increase to a higher level of military orders for a sustained period. The Finletter Commission result was the first of five events that came in rapid succession, as had the shocks that transformed the aircraft industry during the Second World War. These events initially interrupted the Wave Development Cycle pattern, into which the American aerospace industry from 1948 to 1969 does not fit. Russian postwar imperialism in Europe was increasingly recognized with alarm, and the cold war came into the open in 1948 when the Russians moved against Berlin and the Americans chose an airlift as the counter move. Thanks to the experience of the airlift to China in the war, and to the availability of the same leader, General William H. Tunner, the effort was improvised successfully. Lessons were learned that were to be valuable in later periods of dense airline traffic, and recognition of the importance of military air transport led to an expanding market for the aerospace industry. Not only the United States but Western Europe was alarmed by Russia's actions, and the North Atlantic Treaty Organization (NATO) was formed in 1949 to halt the use of force to spread communism. The American contribution of forces to Europe and the equipping of allies lacking the capability to build modern aircraft enlarged our exports. The third event that occurred to interrupt the wave cycle was the development of air coach, or tourist, transportation. Started by nonscheduled airlines which were hungry for business, it was adopted by Capital Airlines in 1948. Competition forced its spread to other domestic airlines and, in 1952, across the oceans. Commercial air transportation became truly mass transportation, and a demand was created for thousands of large airplanes. In 1949 the Russians exploded a nuclear device, breaking the American monopoly, and the United States now had to provide for air defense against possible air-nuclear attack A large interceptor force had to be built to defend the expanses of the air approaches to North America, as a result of this crucial postwar event. Finally, in only another year the Korean War broke out, and the USAF was forced to revitalize and expand its tactical air power, which had been deliberately neglected in the peace years while priority had been given to bombers. Naval carrier aviation, too, got a new lease on life by demonstrating its usefulness in limited conventional war. The Navy encountered enemy jets in combat for the first time, and almost complete reequipment became necessary. By the time the Korean War had ended in 1953, the aerospace industry had undergone a massive expansion and was restored to its World War II status as the largest American industry. The five events had caused an expansion in numbers of all categories of aircraft and added a massive new market, the tankers. In 1954 sales of ten aircraft companies totaled about $4.5 billion, nine times the 1947 level. Profits were around $170 million in 1954 in contrast with the heavy losses of 1947. The recovery was not smooth, and there was one casualty and three near casualties. Curtiss-Wright failed to win contracts as a prime contractor and withdrew from aircraft design. A combination of little government business and early losses with its airliner brought Convair to a crisis, but it was saved by successful development of the B-36, which went into production in 1947; in 1954 Convair was merged into General Dynamics, becoming part of John Jay Hopkins' effort to build a General Motors of the defense industry. Martin's ill-fated attempts to build an airliner brought it to the brink of failure in 1947, from which it was rescued by a loan from the government's Reconstruction Finance Corporation (RFC); a second government rescue took place when Martin ran low on funds in a renewed airliner effort combined with expansion during the Korean War. The second transfusion was made mostly with wartime V-loans. Like Convair, Northrop was shaky when a design, the F-89 interceptor, was accepted for production in 1949; but this was a temporary reprieve, for the F-89 was soon made obsolescent by the F-102. Unlike previous American wars, the Korean War was not followed by massive demobilization. Indefinite maintenance of large armed forces and the existence of a substantial air-transport industry appeared to have ended the boom-and-bust days of aircraft manufacture. The Truman level of defense spending, around $15 billion, was increased to the Eisenhower level of around $40 billion. Similar continuity was true of the aerospace industry as a whole, and production was fairly stable between the Korean War and the Vietnam War. But there was to be no routine peacetime equilibrium in the fifties, even though the hand-to-mouth existence had ended. The political, economic, and military events that had interrupted the wave cycle were followed by technological revolutions that were to keep the aerospace industry in ferment. THE JETS TAKE OVERThe Korean War marked the watershed between piston and jet production. In 1950 more than half of production was piston; in 1953 this was reversed. By the end of the war, the aerospace industry had built 10,000 jets for the Air Force, 3,500 for the Navy, and 2,000 for export. Lockheed alone had built 5,000.The reequipment of the Navy with jets as a result of the Korean War was the most conspicuous conquest by jet propulsion in the early fifties. As early as the spring of 1951, there were no Air Force or Navy development contracts for a piston aircraft. The Air Force, having already accepted the jet for fighters and short- and medium-range bombers, did not appear to reequip so broadly. Yet marked progress in jet engine efficiency and the introduction of thrust augmentation, or afterburning, meant major changes that virtually eliminated an expected competitor in engines, the propjet. The main aerodynamic problems of high-speed flight had been resolved. The intercontinental jet bomber and supersonic fighters became feasible, and the Air Force started development of propjet transports, the last stand of this engine. With jet trainers developed from the F-80, it was moving rapidly towards an all-jet force. British development of the first jet airliner, the De Havilland Comet, which began service in 1952, forced the hand of American aerospace manufacturers. The success of the Comet weakened the reluctance of the conservative American airlines to use jets and caused manufacturers to fear a loss of exports. Consequently, the aerospace industry began a race for the jet airliner market, and by the early sixties the jets, primarily the Boeing 707 and Douglas DC-8 families but also the turboprop Lockheed Electra, dominated the American airliner scene. The jet's great advance over the piston in its power-to-weight ratio enabled aircraft to grow in size and weight, and this capability was accompanied by the parallel technological explosion in avionics for navigation, weapons control, and electronic warfare measures. Aircraft empty weights increased drastically, as can be seen in Table II-1. Empty weights are given in the table because they best show the effects on design and manufacturing, but it should be noted that the impact of the jet's efficiency is sometimes even more dramatically evident from gross weights. For example, the gross weights for the B-50 and B-52 were 175,000 and 480,000 pounds, respectively. The increased size and weight plus the need for strength in highspeed flight changed the production systems of the manufacturers. Instead of being primarily sheet metal processors, they became great machine shops and thus were even more capital-intensive than before. After the Korean War, especially in 1957, the government tried to reduce as much as possible its financing of the aerospace industry's plant, equipment, and inventories, and this forced the industry to further increase its own investment and, therefore, its financial risks. Appalled during the Korean War by fast-rising costs, some manufacturers made efforts to reverse the trend by emphasizing light, simple aircraft. Only three such attempts succeeded. The Douglas A-4 attack plane, weighing 9,559 pounds, has been one of the most important and highly regarded naval aircraft since the war; it was in continuous production from 1954 into the seventies. The other two, the F-104 and the F-5, weighing 15,000 and 7,596 pounds, did not please the USAF, which has traditionally favored heavily equipped aircraft; but they found wide markets abroad and some limited adoption by the U.S. forces. TABLE II-I GROWTH IN AIRCRAFT SIZE, 1946-1960

The Eisenhower administration started with the intent to avoid what it believed was a Truman administration error: to stint on defense. Soon dismayed, however, by total budget costs and by accelerating cost increases per aircraft, the Eisenhower government shrank from its original intentions and sought to contain the defense budget within a fixed amount. By the sixties, the rises in real cost, inflation, and the emergence of a plethora of new defense systems meant disruptive cancellations and less prosperity than the aerospace industry had expected. MISSILES AND SPACEAs the fifties began, small tactical missiles were ending development, and by 1955 six types were in service. In 1953 the Russians exploded a "dry" hydrogen bomb, a revolutionary development in explosives that meant that large, long-range missiles were practical. And those that were suborbital space vehicles made space flight possible.Awareness of Russian missile possibilities led the government to give priorities to the development of intercontinental and intermediate range ballistic missiles (ICBM's and IRBM's). To ensure success, parallel development of the General Dynamics Atlas and the Martin Titan ICBM's were ordered. Similarly, the Douglas Thor and the Army-Chrysler Jupiter IRBM's competed. Later a breakthrough in solid propellant technology led to noncompetitive parallel development of the land-based Boeing Minuteman ICBM and the Lockheed Polaris IRBM, or Fleet Ballistic Missile (FBM). Because missiles were a natural outgrowth of aircraft technology, many believed that there would be a transitory stage of jet-powered guided missiles, sometimes called unmanned aircraft. But before these missiles of the fifties became operational in even limited quantities, they were found to be highly vulnerable to advances in air defense, and development and production ended. Advances in technology made missiles practical across the whole spectrum: air-to-ground (or surface), ground-to-air, air-to-air, and ground-to-ground. The successes achieved, and the fact that missiles are cheaper to produce, led to the belief that manned combat aircraft would soon be made obsolete, or at least less important in sales volume, either because of missile effectiveness or perhaps because of cost. In this break with the past, firms such as Hughes and Chrysler, which had not participated earlier in aerospace prime contracts, began to bid for and get programs. Some of the traditional aerospace companies began to have difficulty getting contracts for military aircraft. Boeing feared the end of its traditional, heavy-bomber business. Boeing and Douglas began producing relatively more and more commercial, not military, aircraft. Fairchild never found a successor to its C-119, the "dollar nineteen," which ceased production in the midfifties. Grumman lost ground in competing with McDonnell in fighters and sought to carve a new niche in specialty aircraft such as rescue, utility, antisubmarine warfare planes, and so forth. Martin gradually lost out on the production of types other than Hying boats. When the dead-end was reached in Hying boats, Martin "withdrew" from aircraft manufacture, although it has tried to reenter since, without success. North American's last important production aircraft was the F-100, and most of its airplane business since has been developmental or of minor types. In the late fifties there was widespread concern over these developments. If a company was down to one or two products, sudden cancellation, a common occurrence, could cause bankruptcy. A new wave of diversification swept the industry, for the most part pushing the trend towards missiles and space. Another direction was to invade the avionics market, just as the avionics companies had entered the missile business. Because the aerospace companies already had a minimal avionics capability as prime contractors, it was simply a matter of expansion rather than entry into a new market. Lockheed emulated General Dynamics and tried to become more of a general defense contractor, while General Dynamics and Martin entered the construction business through merger, because construction was expected to be countercyclical to defense. A large new market, comparable to missiles in sales, was space vehicles. Russia's skillful exploitation of space with its first Sputnik satellites shattered America's confidence and world prestige and led to a national convulsion as the United States launched a massive effort to catch up with the Soviets. American frustration at the Russian lead is illustrated by a note which appeared on a Pentagon bulletin board: "Although Soviet Russia leads the U.S. in rocket propulsion, the U.S. maintains its lead in such vital areas as miniaturization. Otherwise it would not have succeeded in building a space program so much smaller than the one Russia has."1 At first it appeared that there would soon be major military activities in space, but these prospects faded and the main activity became the race for the moon. This new market was large for the aerospace manufacturers who successfully bid to build boosters and spaceships, but it was also a crash program which emphasized speed in development and manufacturing and disregarded cost. And at its peak it did not equal military aircraft sales. THE JETS ARE CONFIRMED: THE VIETNAM WARJust as Eisenhower had criticized the level of defense spending under Truman, so did Kennedy react to his predecessor. The new administration doubled the defense budget, expanding conventional arms. At the same time, a major effort was made to reduce governmental costs, and management and procurement formulas were sought which would drastically reduce government costs while improving company profits.Costs had continued to skyrocket with the technological developments of the fifties. The piston DC-7 of 1955, which had cost $1.9 million, was replaced by the jet DC-8, whose price was around $5 million by 1960. The DC-8 was more productive than the DC-7, however, and was actually cheaper when all costs and income were figured. Its speed, capacity, and useful life meant the capital cost per unit of output was 43 percent less than the DC-7C, and 20 percent less than the DC-6B. Similar advancement in the efficiency of new designs enabled Defense Secretary Robert S. McNamara to reduce the number bought. He also sought to reduce the degree of aircraft specialization into different types, and he deliberately increased the contractors' business risks so as to encourage vigorous cost-reduction efforts on their part. After the first big missiles were in place, production of the Minuteman and Polaris/Poseidon continued as improved models replaced earlier versions. The experience in Vietnam, and the accumulation of several years of missile service, led to some disenchantment with missile capability. Earlier expectations were not fulfilled, although it was evident that missiles had a major role, and models that had become obsolete for military uses were kept in service in the space program. The overall outcome was a rough plateau of sales for the industry at around $16 billion from 1962 until the Vietnam War in 1965, but financial crises occurred throughout the period. General Dynamics lost a crushing $425 million, mostly in 1960 and 1961, in its efforts with the 880/990 airliners to hold or expand its commercial business. Lockheed and Fairchild took severe losses in 1960 in similar attempts. The three companies were driven out of competition by Boeing and Douglas, the main commercial transport survivors in the early sixties. Both of the latter, however, were faced with a steady decline in their government business, a serious development for an aerospace firm. Essentially these five companies, against their will, were becoming increasingly concentrated in their markets despite their desire for diversification. McNamara's drive to reduce specialization meant that the Navy's McDonnell F-4 became a biservice fighter, putting an unexpected early end to Republic's F-105 production. Republic limped along on its subcontracting and other business for a while and was then absorbed by Fairchild in 1965. Fairchild itself had to struggle to survive with a shortrange airliner, the FH-227, subcontracting, and other minor business. McDonnell sought diversification into the commercial field by merging with Douglas in 1963, but Douglas rejected the proposal. North American sought diversification beyond the broad aircraft-missile-space activities it had developed and merged with Rockwell Standard, primarily in the automotive business, in 1967. The Vietnam War increased military aircraft purchases, and at the same time there was a renewed wave of airline buying. The war did not actually increase sales proportionally as much as earlier wars had, because of the government's efforts to economize and because of a low loss rate. But prospects for continued use of piston aircraft were apparently ended, as Secretary McNamara, came to the conclusion that piston aircraft were not as cost-effective as jets. The leading piston attack plane, the A-1, was estimated to cost $800,000 in 1965, a fourfold to fivefold increase over the late 1940's. The jet revolution for military aircraft was complete. The number of airliners produced doubled from 1964 to 1966, and doubled again by 1968, and total sales of the aerospace industry rose by over half from 1965 to 1968, the peak year up to that time. Douglas benefited little from Vietnam War orders but had a great surge in the airliner business, and found itself with a massive financial problem because of expansion. Despite its success in getting several large loans, its capital needs outran the impaired confidence of its creditors, and Douglas had to seek a merger in 1966; it was absorbed in 1967 by McDonnell, which was still desirous of diversifying.

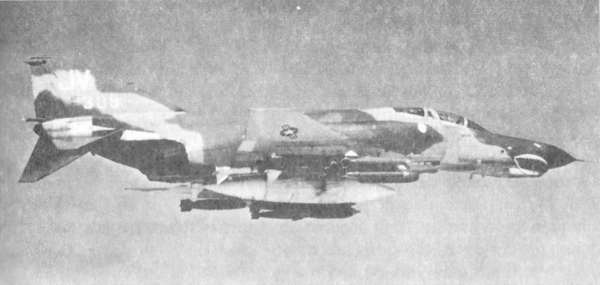

A highly successful design, the F-4 contributed greatly to the rise of the McDonnell company. Courtesy McDonnell Douglas Corporation When the Nixon administration began disengaging from Vietnam in 1969, the race for the moon was over and won, and airline buying was also slackening off. Sales fell again, and Boeing entered a period of doldrums when the supersonic transport was abandoned. General Dynamics had a third period of crisis in 1969 and 1970, as a result of F-111 costs and of trouble in its diversified lines. But the most spectacular crisis was Lockheed's. In the midst of a renewed diversification attempt with a new airliner, the L-1011 TriStar, costs drove the engine supplier, Rolls Royce, into bankruptcy in 1971. Having already undergone a government-ordered loss of $200 million on the C-5A, and cancellation of the Cheyenne helicopter program, Lockheed faced bankruptcy, a situation it had diversified to prevent. Lockheed's crisis was unique because it had simultaneous, multiple-program difficulties, and the government came to the rescue with guarantees on private loans, in the fourth large-scale attempt to save an aerospace company since World War II. Costs continued to skyrocket, plaguing manufacturer and customer alike. The Lockheed TriStar, weighing 240,000 pounds empty, was selling for $15 million in 1968, in contrast to the DC-8 price, at roughly half the weight, of $5 million in 1959. The small airliners were up in price also. By 1972 a sort of profitless survival appeared to have set in. Total aerospace industry sales seemed to have leveled off at around $20 billion, including business aviation. The peak had been reached in 1968 with sales of nearly $30 billion. The sales of military aircraft and missiles paralleled the total, leveling at around $8 billion and $5 billion, respectively. Space sales appeared to be in a steady decline from their 1966 peak of $6 billion and were down to around $3 billion. Commercial transport sales, after a peak of $4 billion in 1968, seemed to be holding at well under $3 billion. It seems evident there was overcapacity. The aerospace industry since World War II, then, is the story of an increasingly capital-intensive business whose manufacturing function has steadily declined, and its product cost has risen so high that it has almost priced itself out of its market. It is an industry which has, perhaps with the sole exception of North American, not been able to diversify adequately to shelter itself against its captive status in relation to its dominant customer, the government. Its crises have shrunken the numbers, but there may still be too many units for all to survive. In the United States the government has discouraged merger, in contrast to British policy; but there has been some temporary associating, as in the F-111, which was a General Dynamics-Grumman project, and even on an international basis, between Lockheed and Rolls Royce, for example. The industry has thrived on successive waves of favorable political, economic, and technological revolution. If these frequent growth surges have now stopped, the industry faces a precarious future with its high overhead and its expensive, efficient, and durable product.

Perhaps Lockheed, suffering simultaneous disasters in different activities,

is a dramatic prototype of the whole of today's aerospace industry.

If it does face little growth in its military, space, and commercial markets,

the industry appears to have returned to the interrupted wave cycle pattern:

it has gone through demobilizational instability as Nixon wound down the

Vietnam War, and it is now in peacetime equilibrium.

|